The excavator parts HS code is a critical identifier in global trade. Classified under Chapter 84, subheading 8431.49, it represents parts designed exclusively for machinery listed in headings 8425 to 8430. This code ensures customs authorities can accurately assess duties and taxes, facilitating smooth cross-border transactions. Over 200 countries rely on the Harmonized System (HS) for product classification, making it a universal standard. By using the correct HS code, you can avoid delays, ensure compliance, and streamline your international trade operations.

Key Takeaways

The HS code for excavator parts is 8431.49, which is essential for accurate customs classification and compliance in international trade.

Using the correct HS code helps avoid delays and penalties, ensuring smooth customs clearance and efficient trade operations.

Familiarize yourself with the specific details of your excavator parts, including their function and material composition, to ensure accurate classification.

Utilize reliable resources like the Harmonized System Explanatory Notes and national customs databases to assist in identifying the correct HS code.

Consult with customs brokers or trade experts to navigate the complexities of HS code classification and avoid costly misclassifications.

Stay informed about updates to HS codes by monitoring official announcements and subscribing to industry newsletters to maintain compliance.

Partnering with experienced companies like YNF Machinery can provide valuable support in HS code classification and documentation, streamlining your trade processes.

Understanding the Excavator Parts HS Code

What is the HS Code for Excavator Parts?

The excavator parts HS code is a classification tool used in international trade. It identifies products for customs purposes and ensures accurate tariff application. Excavator parts fall under Chapter 84, specifically subheading 8431.49. This subheading covers “Parts suitable for use solely or principally with the machinery of headings 8425 to 8430.” These headings include machinery such as cranes, excavators, and bulldozers. By using this code, you can streamline customs clearance and avoid unnecessary delays.

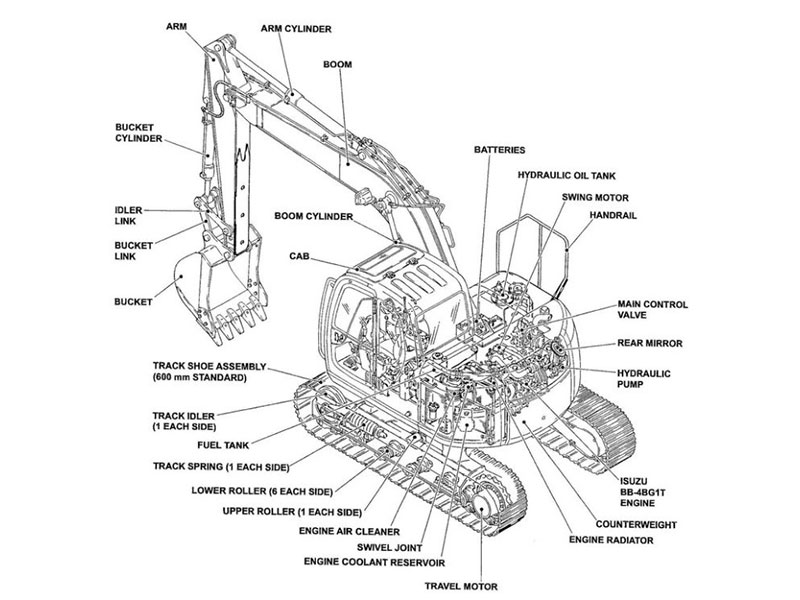

The HS code system is globally standardized. Over 200 countries use it to classify goods. This ensures consistency in trade documentation and compliance. For excavator parts, the 8431.49 code applies to components like toggle linkages, backhoe attachments, and engine parts. Using the correct code helps you meet trade regulations and simplifies the import-export process.

How the HS Code 8431.49 Applies to Excavator Parts

The HS code 8431.49 specifically applies to parts designed for heavy machinery. These include excavators, bulldozers, and other equipment listed under headings 8425 to 8430. The code ensures that customs authorities can identify and categorize these parts accurately. For example, rubber tracks, bucket cylinder seal kits, and floating seal groups all fall under this classification. These items are essential for the operation and maintenance of excavators.

When you use the correct HS code, you ensure compliance with international trade laws. This reduces the risk of penalties or shipment delays. The code also determines the tariffs and duties applied to your goods. Accurate classification can save you money and time during the customs process. It also helps you maintain a good reputation with trade partners.

Examples of Excavator Parts Classified Under HS Code 8431.49

Several excavator parts fall under the 8431.49 HS code. These include:

Rubber Tracks: Essential for excavator mobility, these tracks provide stability and durability.

Toggle Linkages: These components connect different parts of the excavator, ensuring smooth operation.

Backhoe Attachments: These versatile tools enhance the functionality of excavators.

Bucket Cylinder Seal Kits: These kits prevent hydraulic fluid leaks, maintaining the efficiency of the excavator.

Floating Seal Groups: These seals protect internal components from dirt and debris.

Reduction Gearbox Seals: These ensure the proper functioning of the gearbox by preventing oil leaks.

Electric Parts: These include sensors, switches, and controllers that manage the excavator’s operations.

Each of these parts plays a crucial role in the performance of excavators. By classifying them under the correct HS code, you can ensure smooth customs clearance and compliance with trade regulations.

What Are HS Codes and How Are They Structured?

Definition and Purpose of HS Codes

HS codes, or Harmonized System codes, serve as a universal classification system for goods in international trade. Developed by the World Customs Organization (WCO), these codes ensure that products are categorized consistently across borders. You use HS codes to identify goods for customs purposes, which simplifies trade documentation and reduces errors.

The primary purpose of HS codes is to facilitate global trade. They help customs authorities determine tariffs, duties, and taxes for imported and exported goods. By using the correct HS code, you ensure compliance with trade regulations and avoid costly delays. These codes also play a critical role in legal and commercial documents, such as invoices and shipping declarations.

“HS codes are recognized in 98% of world trade, making them essential for smooth international transactions.”

The Structure of HS Codes

The structure of HS codes follows a standardized format. Each code consists of six digits, divided into sections, chapters, headings, and subheadings. This hierarchical structure allows you to classify goods with precision.

Sections: Broad categories of goods, such as machinery or textiles.

Chapters: Specific product groups within each section. For example, Chapter 84 covers machinery and mechanical appliances.

Headings: Narrower classifications within a chapter. Excavator parts fall under heading 8431.

Subheadings: Detailed descriptions of goods. Subheading 8431.49 identifies parts suitable for machinery like excavators.

This structured approach ensures consistency in product classification. It also helps customs officials and traders navigate complex import and export regulations.

Global Standardization by the World Customs Organization (WCO)

The World Customs Organization (WCO) oversees the global standardization of HS codes. Over 200 countries use this system, making it a cornerstone of international trade. The WCO updates the codes every five years to reflect changes in technology and trade patterns.

Standardization ensures that you can use the same HS code for a product, regardless of the country. This consistency simplifies customs procedures and reduces the risk of misinterpretation. It also promotes efficiency in the global supply chain by ensuring that goods are classified accurately.

By understanding the structure and purpose of HS codes, you can streamline your trade operations. Accurate classification not only ensures compliance but also contributes to smoother transactions and better business relationships.

How to Identify the Correct Excavator Parts HS Code

Guidelines for Classifying Excavator Parts

Classifying excavator parts accurately requires a clear understanding of their function and compatibility. You should start by identifying the specific machinery the part is designed for. Excavator parts, such as rubber tracks or backhoe attachments, fall under HS code 8431.49 because they are suitable for use with machinery listed in headings 8425 to 8430. This classification ensures compliance with customs regulations.

Pay attention to the material composition and design of the part. For example, rubber tracks used in excavators feature a combination of vulcanized rubber, woven steel cords, and forged steel drive lugs. These details help customs officials determine the correct classification. Always review the product description and technical specifications to avoid errors.

When in doubt, consult the Harmonized System Explanatory Notes. These notes provide detailed guidance on classifying goods. They clarify ambiguous descriptions and ensure consistency in classification. By following these guidelines, you can avoid misclassification and ensure smooth customs clearance.

Tools and Resources for Finding HS Codes

Several tools and resources can help you identify the correct HS code for excavator parts. Online HS code lookup platforms are a great starting point. Websites like the World Customs Organization (WCO) and national customs authorities offer searchable databases. You can input keywords like “excavator parts” to find relevant codes.

Trade associations and industry-specific guides also provide valuable insights. These resources often include examples of commonly classified items, such as toggle linkages or bucket cylinder seal kits. They simplify the process by narrowing down the options.

Customs brokers and freight forwarders are another excellent resource. These professionals specialize in HS code classification and can guide you through the process. They use their expertise to ensure accuracy and compliance. Leveraging these tools and resources saves time and reduces the risk of errors.

The Role of Experts in HS Code Classification

Experts play a crucial role in HS code classification. Customs specialists and trade consultants have in-depth knowledge of the Harmonized System. They understand the nuances of product descriptions and can interpret complex regulations. Their expertise ensures that you classify excavator parts correctly.

For instance, a customs expert might analyze the design of rubber tracks to confirm their classification under HS code 8431.49. They consider factors like the weaving steel cord design, which enhances track integrity and flexibility. This level of detail helps avoid disputes with customs authorities.

Consulting experts also minimizes the risk of penalties or shipment delays. They provide accurate documentation and ensure compliance with international trade laws. By working with professionals, you can focus on your business operations while they handle the complexities of HS code classification.

The Importance of HS Codes in International Trade

Role in Customs Clearance and Compliance

HS codes play a vital role in ensuring smooth customs clearance. When you use the correct code, customs officials can quickly identify your goods and process them without unnecessary delays. For excavator parts, the HS code 8431.49 ensures that your shipment is categorized accurately under machinery components. This precision reduces the chances of misinterpretation or rejection during customs inspections.

Compliance with trade regulations becomes easier when you classify your products correctly. Customs authorities rely on HS codes to verify that your goods meet the legal requirements of the importing country. Misclassification can lead to penalties, confiscation of goods, or even legal disputes. By using the correct excavator parts HS code, you demonstrate your commitment to following international trade laws, which builds trust with customs officials and trade partners.

“Accurate HS code classification is the foundation of efficient customs clearance and regulatory compliance.”

Impact on Tariffs and Duties

The HS code you use directly affects the tariffs and duties applied to your goods. Each code corresponds to a specific duty rate, which determines the amount you pay during import or export. For example, using the correct HS code for excavator parts ensures that you pay the appropriate tariff rate, avoiding overpayment or underpayment.

Misclassification can have significant financial consequences. If you use an incorrect code, you might pay higher duties than necessary, increasing your costs. Alternatively, underpaying duties due to misclassification can result in fines or additional charges later. Proper classification helps you optimize your cost structure and maintain profitability in international trade.

Benefits of correct HS code usage:

Accurate duty payments

Cost optimization

Avoidance of financial penalties

By classifying your excavator parts under HS code 8431.49, you ensure that your business operates efficiently and remains competitive in the global market.

Avoiding Trade Disputes and Legal Issues

Using the correct HS code minimizes the risk of trade disputes and legal complications. Customs authorities in different countries rely on the Harmonized System to standardize product classification. When you use the correct code, you align your documentation with international standards, reducing the likelihood of misunderstandings.

Trade disputes often arise from discrepancies in product classification. For instance, if customs officials believe your excavator parts fall under a different category, they may impose additional duties or delay your shipment. These issues can disrupt your supply chain and damage your reputation with clients and partners.

Legal issues can also emerge from incorrect HS code usage. Misclassification might be interpreted as an attempt to evade duties, leading to investigations or sanctions. By using the correct excavator parts HS code, you protect your business from such risks and ensure compliance with international trade laws.

“Accurate HS code usage not only streamlines trade processes but also safeguards your business from costly disputes and legal challenges.”

Challenges in Classifying Excavator Parts Under HS Codes

Ambiguities in Product Descriptions

Classifying excavator parts under the correct HS code often becomes challenging due to unclear product descriptions. Many parts share similar features or functions, which can lead to confusion during classification. For example, a rubber track and a rubber belt may appear similar but serve entirely different purposes. Without precise descriptions, you might misclassify these items, causing delays or penalties during customs clearance.

You need to focus on the specific details of each part. Material composition, intended use, and compatibility with machinery play a significant role in determining the correct HS code. For instance, a bucket cylinder seal kit must be classified based on its function in preventing hydraulic fluid leaks. Misinterpreting such details can result in incorrect classification, leading to higher tariffs or shipment rejections.

“From the pressure and speed of everyday business to the lack of the right knowledge, an incorrect classification is easy to miss if you are not an expert.” — Customs Support

To avoid these issues, you should invest time in understanding the technical specifications of your products. Clear and accurate descriptions help customs officials process your shipments efficiently, reducing the risk of errors.

Variations in National HS Code Extensions

Although the Harmonized System provides a global standard, individual countries often implement their own extensions to the HS codes. These variations can complicate the classification process for international traders. For example, while the base code 8431.49 applies universally to excavator parts, some countries may add additional digits to specify subcategories. This creates inconsistencies that you must navigate carefully.

You need to research the specific requirements of each country you trade with. Customs authorities in different regions may interpret the same product differently based on their national extensions. For instance, a floating seal group might fall under a slightly modified code in one country compared to another. Failing to account for these differences can lead to shipment delays or disputes.

To address this challenge, you should use reliable resources like national customs databases or consult with trade experts. Staying informed about regional variations ensures that your classifications remain accurate and compliant.

How YNF Machinery Simplifies the Process for Clients

YNF Machinery understands the complexities of HS code classification and works to simplify the process for you. With over 35 years of experience in the excavator parts industry, YNF Machinery provides expert guidance to ensure accurate classification. Their team analyzes the technical details of each product, helping you avoid common pitfalls like ambiguous descriptions or regional code variations.

By partnering with YNF Machinery, you gain access to comprehensive support. They assist with documentation, ensuring that your shipments meet international trade standards. Their expertise bridges the gap between your business and customs authorities, reducing the risk of errors or delays.

Key benefits of working with YNF Machinery:

Expert assistance in HS code classification

Accurate and detailed product descriptions

Support with regional HS code variations

Streamlined customs clearance processes

“Our experts are on hand to bridge the gap, helping you classify new goods or audit your existing classifications.” — Customs Support

YNF Machinery’s commitment to quality and reliability ensures that your trade operations run smoothly. By leveraging their expertise, you can focus on growing your business while they handle the complexities of HS code classification.

Practical Tips for Traders and Businesses

Best Practices for Accurate HS Code Classification

Accurate HS code classification is essential for smooth international trade. To achieve this, you should follow these best practices:

Understand the Product Details

Study the technical specifications and intended use of your excavator parts. Knowing whether a part is a rubber track, toggle linkage, or hydraulic seal helps you classify it correctly.Use Reliable Resources

Refer to official resources like the Harmonized System Explanatory Notes or national customs databases. These tools provide detailed guidance on product classification.Document Everything Clearly

Maintain clear and precise descriptions of your products. Include details like material composition, dimensions, and compatibility with machinery. This documentation helps customs officials process your shipments without delays.Consult with Experts

Seek advice from customs brokers or trade consultants. Their expertise ensures that you avoid misclassification and comply with trade regulations.Double-Check Your Work

Review your classifications regularly. Errors can lead to penalties or shipment delays. A second review minimizes the risk of mistakes.

By following these steps, you can ensure that your HS code classifications are accurate and compliant with international standards.

Leveraging YNF Machinery’s Expertise in Excavator Parts

YNF Machinery offers valuable support for businesses dealing with excavator parts. Their expertise simplifies the complexities of HS code classification. Here’s how you can benefit:

Access to Industry Knowledge

YNF Machinery has over 35 years of experience in the excavator parts industry. Their team understands the nuances of product classification and can guide you through the process.Detailed Product Descriptions

The company provides comprehensive details for each part, including material composition and functionality. These descriptions make it easier to classify products accurately.Support with Documentation

YNF Machinery assists with preparing the necessary paperwork for customs clearance. Their support ensures that your shipments meet international trade requirements.Expert Guidance on Regional Variations

The company helps you navigate differences in national HS code extensions. Their knowledge reduces the risk of errors and delays.

“Partnering with YNF Machinery means you gain a reliable ally in navigating the complexities of international trade.”

By leveraging YNF Machinery’s expertise, you can focus on growing your business while they handle the technical aspects of HS code classification.

Staying Updated on HS Code Changes

HS codes undergo periodic updates to reflect changes in technology and trade patterns. Staying informed about these updates is crucial for maintaining compliance. Here’s how you can keep up:

Monitor Official Updates

Follow announcements from the World Customs Organization (WCO) and national customs authorities. These organizations release updates every five years.Subscribe to Industry Newsletters

Many trade associations and customs brokers offer newsletters that highlight changes in HS codes. Subscribing to these resources keeps you informed.Attend Trade Seminars and Workshops

Participate in events focused on international trade. These gatherings provide insights into upcoming changes and their implications for your business.Use Online Tools

Leverage online platforms that track HS code updates. These tools allow you to search for the latest codes and understand their applications.Work with Experts

Collaborate with professionals who specialize in HS code classification. Their expertise ensures that you stay compliant with the latest standards.

By staying updated, you can avoid misclassification and ensure that your trade operations remain efficient and compliant.

The excavator parts HS code, specifically 8431.49, plays a crucial role in ensuring accurate customs clearance and trade compliance. By understanding and applying this code correctly, you can avoid delays and maintain smooth international trade operations. YNF Machinery offers high-quality excavator parts and expert guidance to help you navigate the complexities of HS code classification. Using reliable tools and consulting professionals ensures your trade processes remain efficient. Staying updated on HS code changes and following best practices helps you prevent costly errors and streamline your business operations.